The fastest-growing player in sustainable investment products

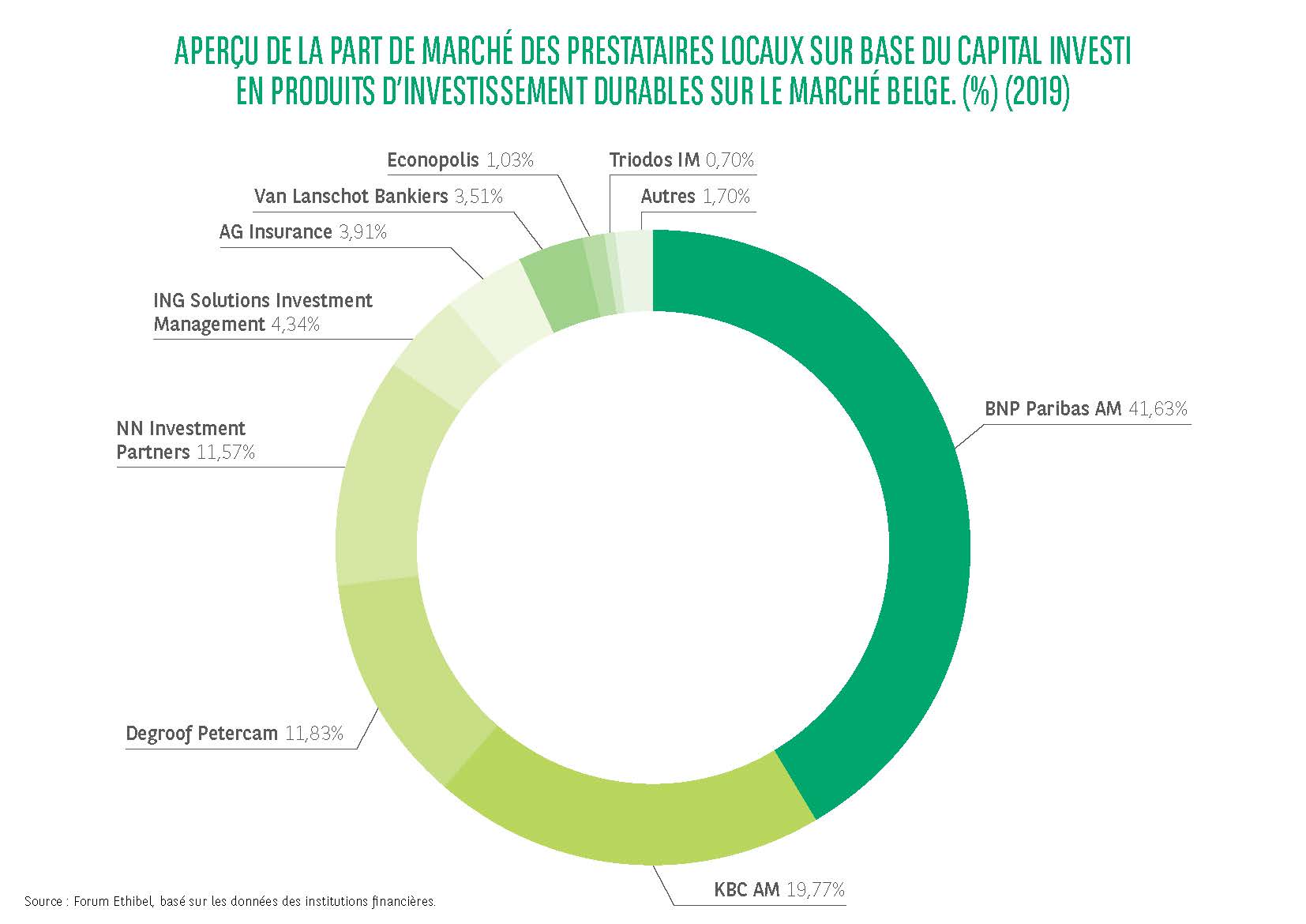

The MIRA report shows that the Bank’s market share in sustainable investments rose from 34.7% to 41.6% in 2019, and that we make more determined efforts in this field than other financial players. This is what the Belgian market looked like in 2019:

(Source: Ethibel Forum, on the basis of the data provided by financial institutions)

Sustainability becoming ever more important

The MIRA report indicates the current situation on the Belgian market with regard to Socially Responsible Investing (SRI). The trend is clear. The importance of SRI, of which sustainability is a component, has been increasing by leaps and bounds over the last few years. This is because our investment clients and we, as an SRI-conscious bank, have together been strengthening the trend towards greater sustainability in our society.

Socially Responsible Investing

Socially Responsible Investing means that when selecting investment products you consistently take account of Environment, Social and Governance (ESG) criteria or you ask your bank to do that for you, as described in a previous article.

SRI on the rise

Year after year, interest in SRI is rising steadily. The volume of SRI products subscribed by Belgian clients worked out more than 74% higher in 2019 than the previous year – the strongest growth in a single year since the Ethibel SRI index started up in 1992. With no fewer than 93 investment products rated in this category, our Bank accounted to a large extent for the increase.

Ethibel Forum

The MIRA report is published annually on the Ethibel website. Ethibel Forum, whose stated aim is to promote transparency, social responsibility and sustainable conduct on the financial markets, works towards these goals in conjunction with Flemish government environment agency VMM and the University of Antwerp.

We see making Socially Responsible Investments as widely available to our clients as possible as an important part of Positive Banking.